Upside, initially known as GetUpside, is a prominent cashback app that has been creating significant waves in the consumer market.

It provides users with cashback rewards on their everyday purchases at various outlets, including gas stations, grocery stores, and restaurants.

Understanding how Upside generates revenue is essential to comprehend its business model and sustainability.

History of Upside

The Founding and Initial Concept

Upside, initially known as GetUpside, was co-founded by Alex Kinnier and Thomas Vaughan. Before Upside, Kinnier and Vaughan had considerable experience in the tech industry, particularly at Opower, a customer engagement platform for utilities.

It was at Opower that they met their future co-founders – Rubio, Kochaniak, McPhee, and Vaughan. In 2016, following the sale of Opower to Oracle, the team decided to embark on their entrepreneurial journey, leading to the inception of Upside.

Early Funding and Launch

In its early stages, Upside was bolstered by a $6 million seed funding round, which was a testament to Kinnier’s strong connections in the venture capital world.

This initial funding was crucial in bringing Upside to life. In December 2016, the app was unveiled to the public, marking the beginning of its journey in the competitive cashback app market.

Strategic Focus and Expansion

Initially, Upside focused on providing cashback deals for gas stations, quickly gaining traction in this niche market.

Recognizing the potential to expand its offerings, Upside started forming partnerships with notable companies like BP and Kmart.

These partnerships were pivotal in extending the app’s reach and enhancing its value proposition to users.

Adaptation and Growth Amidst Challenges

The year 2020 was a significant period of growth for Upside, largely due to the economic impact of the COVID-19 pandemic.

As consumers looked for ways to save money, Upside’s user base expanded significantly.

This growth phase enabled the company to secure additional funding, including a $35 million Series C round led by Bessemer Venture Partners.

Diversification and Rebranding

Understanding the need to diversify, Upside began to partner with various companies outside of the gas station sector. Notable partnerships included those with DoorDash, Instacart, and Uber.

These collaborations allowed Upside to tap into new user segments and broaden its market reach.

In 2022, as a part of its evolving strategy, the company rebranded from GetUpside to Upside, reflecting its broader market appeal and diverse offerings.

The Path Ahead

Today, Upside stands as a testament to innovative entrepreneurship and strategic market positioning.

From its focused beginnings in the gas station cashback market to its expansion into various sectors and strategic partnerships, Upside’s journey is a compelling story of growth, adaptation, and success in the competitive world of cashback rewards.

Revenue Generation Model

1. Affiliate Commissions

The core of Upside’s revenue generation lies in its affiliate commission structure.

The app partners with over 20,000 businesses and receives a portion of the profit from transactions made through it.

When consumers make a purchase eligible for cashback, Upside earns a share of the profit generated by these partners.

This model is similar to other cashback apps like Ibotta or Fetch Rewards.

2. Machine Learning for Personalized Offers

Upside employs machine learning technology to offer personalized deals to its users.

By analyzing spending history and behavior through data points like debit/credit card transactions and location data, the app can recommend additional products to consumers, thereby increasing sales volumes and profits for its partners.

This personalization strategy not only benefits the partners but also enhances the user experience on the app.

3. Premium Subscription Tier

Upside has introduced a premium subscription tier that provides users with enhanced benefits and exclusive deals.

Subscribers gain access to a broader range of partner businesses and higher cashback rates on select products and services.

This tier, designed for users who aim to maximize savings, contributes significantly to Upside’s revenue.

4. Dynamic Pricing Strategy

Upside uses a dynamic pricing strategy, particularly with gas stations, where cashback rates vary based on market conditions. This strategy drives revenue while offering attractive discounts to users.

Upside analyzes real-time data on prices and demand, allowing them to adjust cashback rates dynamically, benefiting both consumers and partner businesses.

5. Creating a Symbiotic Ecosystem

At its core, Upside’s business model is about creating a win-win ecosystem. Users save money through cashback rewards, businesses attract customers with exclusive deals, and Upside earns a commission from these transactions.

It also leverages its user base and anonymized consumer spending data, selling this information to businesses and marketers for additional revenue.

This data monetization strategy ensures the app remains free for users while diversifying Upside’s income sources.

6. Expansion and Partnerships

Upside’s growth strategy includes expanding into associated business lines and forming strategic partnerships.

For instance, their collaboration with GasBuddy and Uber allowed these platforms to offer Upside’s cashback rewards to their users.

Upside’s partnerships and expansion into different markets play a crucial role in its revenue generation.

How Upside Works

Upside, known for its user-friendly interface and simplicity, is designed to provide cashback rewards to its users for everyday purchases.

Here’s an overview of how the app functions:

Downloading and Setting Up the App

Users begin by downloading the Upside app from the Apple App Store or Google Play Store.

The setup process is straightforward, requiring users to create an account. This setup includes linking a debit or credit card to the app, which is essential for tracking eligible purchases and providing cashback.

Finding Offers and Participating Locations

Once set up, users can explore the app to find cashback offers near them. Upside partners with thousands of businesses across the United States, including gas stations, restaurants, and grocery stores.

The app uses the user’s location to display relevant offers in their area. Notable partners include popular chains like Dunkin’ Donuts, Burger King, and various fuel stations like BP, Shell, and Exxon.

Making Eligible Purchases

To avail of the cashback offers, users simply need to make a qualifying purchase at a participating location.

This can be done by using the linked credit or debit card or by submitting a receipt through the app.

For gas stations, users often have to “check in” on the app before they make a purchase.

Earning and Redeeming Cashback

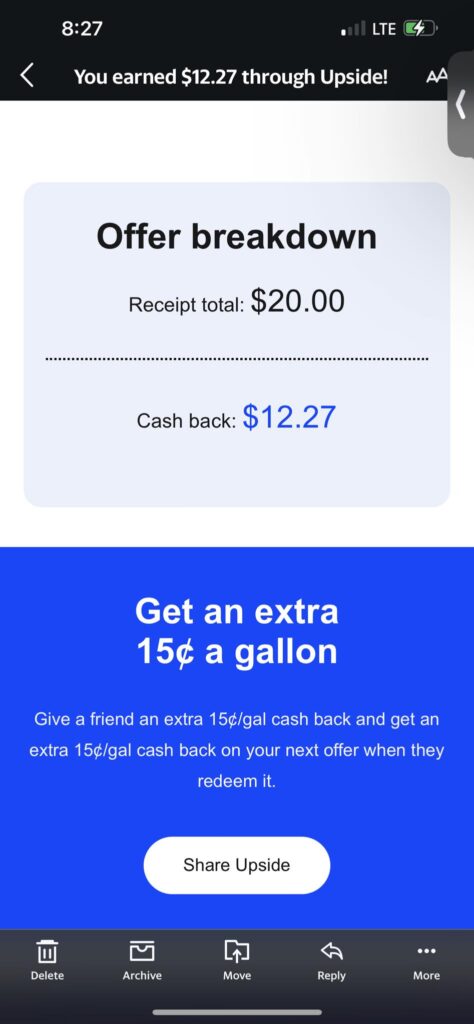

After a purchase is made and verified, cashback is credited to the user’s Upside account.

The amount of cashback varies based on the specific offer and the total purchase amount.

Users can then transfer their earned cashback to their bank account, PayPal, or convert it into gift cards, as per their preference.

User Benefits

The primary benefit for users is the ability to earn money back on purchases they would be making anyway.

This can lead to significant savings over time, especially for frequent buyers.

The app also occasionally offers higher cashback rates for specific products or services as part of limited-time promotions.

Business Advantages

For businesses, joining Upside’s network and offering cashback rewards is a way to attract new customers and increase sales. Upside uses purchase history data to help businesses target and acquire new customers at no initial cost.

It only earns a profit if the partnered business profits from sales made through the app, making it a low-risk marketing strategy for businesses.

Security and Privacy

Upside takes user privacy and data security seriously. While the app tracks spending history for personalized offers, it ensures that all personal data is anonymized and securely handled.

Upside Funding, Revenue, and Valuation

Funding Rounds and Investments

Since its inception, Upside has successfully attracted significant investment through various funding rounds.

The journey began with a substantial $6 million seed round in early 2016, which was instrumental in getting the app off the ground.

This early investment showcased the faith investors had in Upside’s potential and the experience of its founding team.

As Upside expanded and demonstrated its potential, it continued to attract more investments.

One of its significant funding milestones was the Series C round led by Bessemer Venture Partners in September 2020, where the company raised an additional $35 million.

This round of funding was particularly notable as it occurred during a challenging economic period marked by the COVID-19 pandemic.

Revenue Growth and Financial Performance

Upside’s revenue model, primarily based on profit-sharing arrangements with partner businesses, has led to substantial financial growth.

While specific revenue figures are not publicly disclosed, the company’s success in expanding its user base and partnering with over 20,000 businesses across the United States suggests a healthy and growing revenue stream.

The app’s ability to attract major brands and its increasing popularity among consumers further indicate a solid financial footing.

Valuation and Market Position

One of Upside’s most remarkable achievements was its valuation during the funding rounds.

In March 2022, the company was valued at $1.5 billion, a testament to its market potential and the success of its business model.

This valuation placed Upside among the leading players in the cashback app market and showcased its potential for future growth and expansion.

You may also like // Gently Soap Shark Tank Update | Net Worth

Conclusion

Upside’s innovative approach to cashback rewards has not only benefitted consumers but also created a sustainable business model.

Through affiliate commissions, machine learning for personalized offers, a premium subscription tier, dynamic pricing strategies, and a symbiotic ecosystem of partnerships, Upside continues to grow its user base and profitability.

This multifaceted revenue model ensures that Upside remains a key player in the cashback rewards market.