Coinout is a free mobile application that allows users to receive cashback for their purchases. The app was founded in 2016 by Jeffrey Witten, a graduate of the University of Pennsylvania’s Wharton School of Business. Coinout has since gained popularity, with over 2 million downloads from the Google Play Store and Apple App Store combined. But how does Coinout make money?

In this blog post, we’ll explore the different ways Coinout generates revenue and sustains its business model. We’ll discuss its primary source of income, partnerships, and other possible sources of revenue.

How does Coinout Work

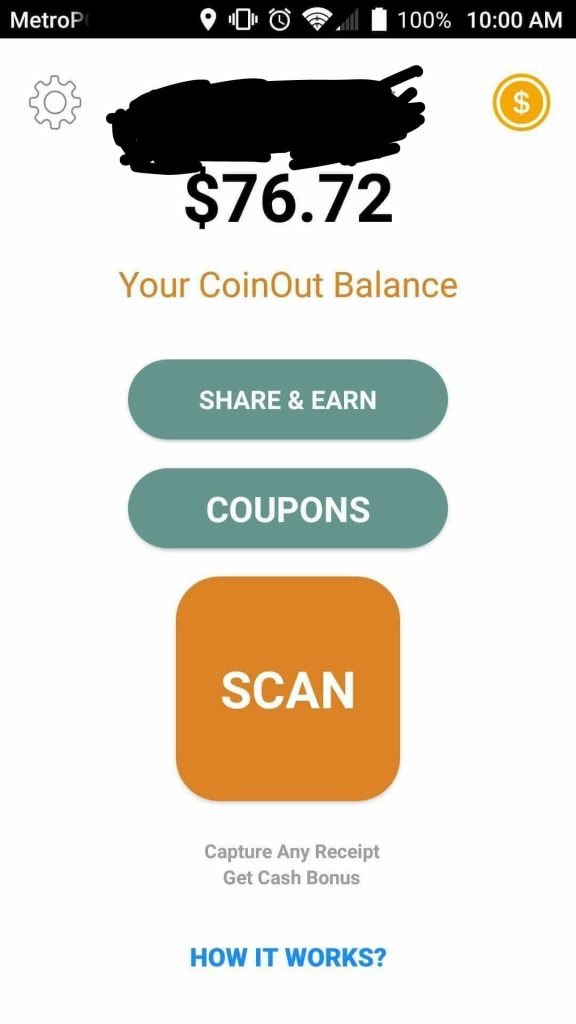

Coinout is a mobile application that allows users to earn cashback rewards for their purchases.

Here’s how it works:

- Download and Install: Users can download and install the Coinout app from the Google Play Store or Apple App Store for free.

- Sign Up and Link Your Account: Once the app is installed, users can sign up for a new account by providing basic information such as their name, email address, and phone number. Users can also link their bank account or credit card to their Coinout account.

- Make Purchases and Upload Receipts: Users can make purchases at any retailer and upload their receipts to the Coinout app. The app supports all types of receipts, including paper, email, and digital receipts. Users can also link their loyalty cards to the app, which will automatically credit cashback rewards for purchases made at participating retailers.

- Receive Cashback Rewards: Coinout calculates cashback rewards based on the total amount spent on purchases and credits the rewards to the user’s account. The amount of cashback rewards varies depending on the retailer and the specific promotion. Users can redeem their cashback rewards for gift cards or transfer the funds to their bank account.

- Make Purchases Using Coinout Pay: Users can also make purchases directly through the app using their Coinout balance. Coinout Pay is accepted at participating retailers and offers users an easy and secure way to make purchases without the need for a physical wallet.

History of Coinout

Coinout was founded in 2016 by Jeffrey Witten, a Wharton School of Business graduate. Witten was inspired to create Coinout after observing the frustration of small business owners who were unable to accept credit card payments due to high transaction fees. Witten believed that there was an opportunity to create a mobile app that would allow users to make purchases using their smartphones while also earning cashback rewards.

Initially, Coinout was focused on providing a simple and convenient way for users to earn cashback on their purchases. The app allowed users to upload receipts from any retailer and receive cashback rewards based on the total amount spent. Coinout quickly gained popularity among consumers who appreciated the simplicity and flexibility of the app.

As Coinout’s user base grew, the company began to focus more on partnerships with merchants. Coinout established relationships with local and national retailers, including Walmart, McDonald’s, and Target, and began to offer cashback rewards for purchases made at these retailers through the app.

In 2018, Coinout announced that it had secured $1.7 million in seed funding from a group of investors that included Highline Beta, Techstars Ventures, and Quotidian Ventures. The funding allowed Coinout to expand its operations and further develop its platform.

In 2019, Coinout introduced a new feature called Coinout Pay, which allows users to make purchases directly through the app using their Coinout balance. Coinout Pay is accepted at a growing number of retailers and offers users an easy and secure way to make purchases without the need for a physical wallet.

Today, Coinout continues to grow and expand its operations. The app has been downloaded over 2 million times and has established partnerships with over 50,000 merchants across the United States. Coinout’s success can be attributed to its focus on simplicity, convenience, and value for both users and merchants. As the company continues to innovate and expand, it is likely to remain a leader in the mobile cashback rewards space.

Related // How Does Chipper Cash Make Money?

How does Coinout Make Money

Primary Source of Income: Transaction Fees

Coinout earns money through transaction fees charged to merchants for every transaction made by Coinout users. This fee is charged to merchants for every successful transaction made through Coinout, which is usually a small percentage of the transaction amount.

Coinout has partnered with a network of merchants that include local and national retailers such as Walmart, McDonald’s, and Target. Merchants benefit from partnering with Coinout because they gain access to a new customer base, who are incentivized to make purchases through the app by the cashback rewards.

The more successful transactions made through Coinout, the more revenue the app generates through transaction fees. Coinout’s revenue is directly proportional to the number of transactions made through the app.

Partnerships with Advertisers

Another way Coinout earns money is through partnerships with advertisers. Advertisers pay Coinout to run ads and promotions within the app. These ads are targeted to specific users based on their purchasing history and other user data collected by the app.

Coinout’s user data is valuable to advertisers because it provides insights into the shopping behavior of consumers. Advertisers can use this information to create targeted marketing campaigns that are more likely to convert into sales.

By partnering with advertisers, Coinout can monetize its user base without charging them directly. Advertisers benefit from the targeted advertising and Coinout earns money through advertising revenue.

Other Sources of Revenue

In addition to transaction fees and advertising revenue, Coinout has explored other possible sources of revenue. One such source is data monetization.

Coinout collects user data such as shopping history, spending habits, and other personal information. This data is valuable to third-party companies such as market research firms, data analytics firms, and financial institutions. These companies pay for access to Coinout’s user data to gain insights into consumer behavior and market trends.

Another possible source of revenue for Coinout is premium features. Coinout may offer premium features to users for a subscription fee. These premium features could include advanced cashback rewards, exclusive discounts, or early access to promotions.

Also read // How does Borrowell Make Money?

Coinout competitors

Coinout operates in a highly competitive space, with several other cashback rewards and mobile payment apps vying for market share.

Here are some of Coinout’s main competitors:

- Rakuten: Rakuten is a leading cashback rewards platform that offers users cashback rewards for purchases made through its website or mobile app. Rakuten has partnerships with thousands of retailers and offers cashback rewards of up to 40%.

- Dosh: Dosh is a mobile app that offers users cashback rewards for purchases made at participating retailers. Dosh automatically applies cashback rewards to the user’s account, eliminating the need for users to upload receipts.

- Ibotta: Ibotta is a cashback rewards platform that offers users cashback rewards for purchases made at participating retailers. Ibotta has partnerships with over 1,500 retailers and offers cashback rewards of up to 20%.

- Swagbucks: Swagbucks is a cashback rewards platform that offers users cashback rewards for purchases made through its website or mobile app. Swagbucks also offers users the ability to earn cashback rewards by taking surveys, watching videos, and completing other tasks.

- Cash App: Cash App is a mobile payment app that allows users to send and receive money, as well as make purchases using their balance. Cash App also offers a cashback rewards program for purchases made at participating retailers.

These are just a few examples of the many cashback rewards and mobile payment apps that compete with Coinout. Each of these apps offers unique features and benefits, and users will likely choose the app that best fits their needs and preferences. Coinout’s simplicity, flexibility, and partnerships with major retailers are some of the factors that have helped it stand out in a crowded market.

Funding, Revenue & Valuation

Coinout has received funding from several sources since its inception. In 2018, the company announced that it had secured $1.2 million in seed funding from a group of investors that included Highline Beta, Techstars Ventures, and Quotidian Ventures. This funding allowed Coinout to expand its operations and further develop its platform.

Since then, Coinout has continued to grow and attract additional funding. In 2019, the company announced that it had raised $800K in a funding round led by Mucker Capital, with participation from Valor Equity Partners, Garry Tan, and Alexis Ohanian. This funding will be used to expand Coinout’s platform and further develop its products and services.

Coinout generates revenue by taking a percentage of the cashback rewards earned by its users. The company also generates revenue by charging merchants a fee for participating in its cashback rewards program. Merchants pay a percentage of each sale to Coinout in exchange for access to its user base and the ability to offer cashback rewards to customers.

Coinout’s valuation is not publicly disclosed, but it is believed to be in the range of $50 million to $100 million. The company’s strong growth and partnerships with major retailers have helped to drive its valuation higher. With the continued growth of the mobile payments and cashback rewards industries, Coinout is well-positioned to continue to grow and expand its operations in the coming years.

You may also like // How does Lichess Make Money

Conclusion

Coinout is a mobile application that allows users to earn cashback for their purchases. The app generates revenue through transaction fees charged to merchants, partnerships with advertisers, and other possible sources such as data monetization and premium features.

Coinout’s business model is sustainable because it incentivizes users to make purchases through the app, which in turn generates revenue through transaction fees. Coinout’s partnerships with advertisers and data monetization also provide a consistent source of revenue.

Overall, Coinout’s success can be attributed to its ability to generate revenue without charging users directly. The app’s user base continues to grow, and with more successful transactions and partnerships, Coinout’s revenue is expected to increase in the future.